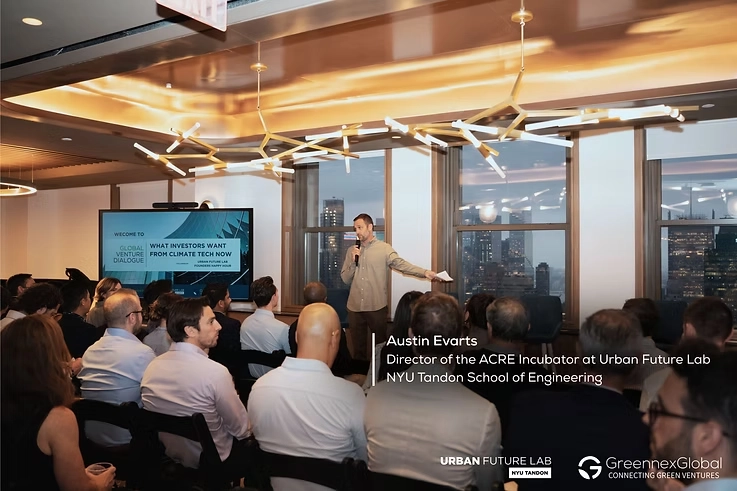

Amid heightened uncertainty in domestic climate tech policy and funding, international interest in cross-border collaboration remains strong. Co-hosted by the Urban Future Lab at NYU Tandon School of Engineering and Greennex Global during New York Climate Week, the Global Venture Dialogue brought together investors, corporate venture investors and ecosystem leaders from across continents to examine how geographic diversification has become essential for climate technology resilience.

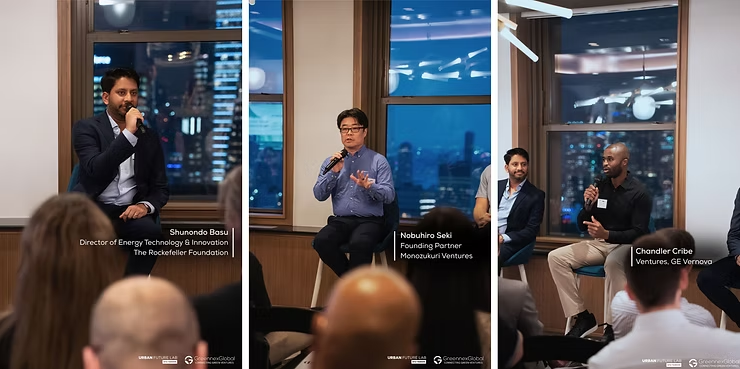

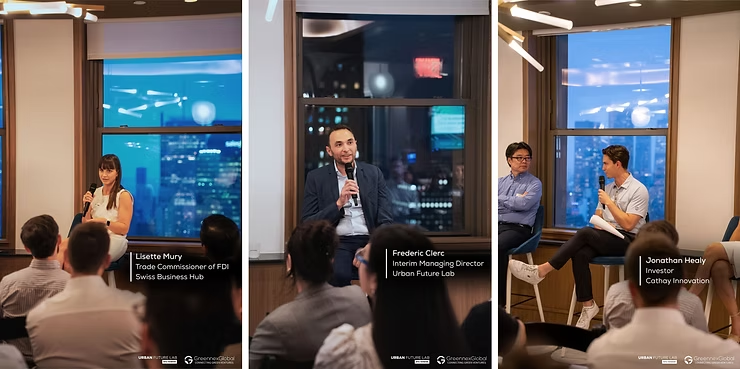

Opened by Austin Evarts, Director of the ACRE Incubator at Urban Future Lab, NYU Tandon School of Engineering, the dialogue featured two panels moderated by Lisa Martine Jenkins, Editor at Latitude Media. Panelists included Jonathan Healy from Cathay Innovation; Lisette Mury, Trade Commissioner at Swiss Business Hub; Nobuhiro Seki, Founding Partner of Monozukuri Ventures; Shunondo Basu, Director of Energy Technology & Innovation at Rockefeller Foundation; Chandler Criber from GE Vernova’s corporate venture team; and Frédéric Clerc, Interim Managing Director of Urban Future Lab.

The dialogue surfaced several critical insights that challenge conventional assumptions about climate tech investment and global expansion:

Geographic diversification has become essential risk management rather than an optional growth strategy. Global investors emphasized how different regulatory environments—from mandatory climate compliance to market flexibility—create varied dynamics that globally-minded startups can leverage for resilience.

Political rhetoric may have, but underlying technology development remains unchanged. Companies rebrand using “resilience” and “infrastructure” terminology while maintaining identical programs. The deeper concern is talent retention—political hostility risks driving away skilled workers, causing more damage than rhetoric changes.

Power grid modernization has emerged as the most underappreciated opportunity. Without upgrades to transformers, power electronics, and microgrids, AI data centers and electrification cannot scale. It’s also a growing concern that energy demand from data centers may begin to approach levels seen in other energy-intensive sectors, such as water desalination.

Investment structure mismatches create barriers. Some international investors face 10-year exit pressures that result in underinvestment of longer-timeline technologies. Corporate VCs prioritize strategic fit over returns, requiring 2-5x improvements and 6-12 months of relationship-building. Coachability matters as much as technical capability.

Local solutions scale better than universal approaches. Deep market understanding translates more effectively internationally. Success requires rapid iteration—quickly testing, recognizing failures, and pivoting—rather than pursuing perfection.

Deployment requires startup-corporate-government alignment. However, this is currently misaligned as corporate interest rises while government support declines. The solution is proving local economic value through cost savings and revenue rather than policy-dependent models.

Underrated opportunities include carbon utilization over storage, fire detection systems, and water infrastructure. Overrated areas include carbon tracking apps, flight offsets without regulation, expensive hydrogen, and nuclear narratives ignoring construction challenges.

In her closing remarks, Stella Song, Founder of Greennex Global, reinforced the dialogue’s central message: being a global startup from day one represents a fundamental type of resilience. Geographic diversification is no longer an optional growth strategy but essential risk management in an era of policy volatility.

The event drew government delegates and stakeholders from nine countries and regions—including the UK, Denmark, Singapore, Japan, Korea, Brussels, France, Germany, and Switzerland—demonstrating sustained global commitment to climate technology collaboration despite policy headwinds. The combined forces will facilitate cross-border scale-up, helping climate startups build the international networks and market access pathways essential for navigating an increasingly complex global landscape.

Stay Connected

Global Venture Dialogue is part of Greennex Frontier, the strategic communication arm of Greennex Global, focused on shaping climate investment narratives and catalyzing cross-border engagement between startups, capital providers, and governments.

This session was co-hosted with the Urban Future Lab at NYU Tandon School of Engineering, New York’s premier innovation hub for climate tech. UFL supports the growth of climate solutions through tailored advisement, multistakeholder collaboration, and industry-building deployment and partnership-focused activities that help startups scale. To explore collaboration opportunities, visit ufl.nyc and sign up to their newsletter.

To follow the Greennex Frontier series or explore engagement opportunities, contact info@greennexglobal.com.